Key Takeaways

- The 87% reflects reach, not readiness. Social Security helps retirees. This number rarely covers the full cost of a long-term recruitment.

- When you claim, it affects monthly pay, survivor protection, and long-term flexibility more than many expect.

- Firm retirement plans are based on testing and not trust. Families who plan for adjustments are more confident compared with those who assume benefits.

Most people assume that Social Security is the safety net that will catch them after retirement. The shortest answer to this is that it helps, but rarely covers everything. According to the Social Security Administration, 87% of Americans aged 65 or above receive Social Security benefits.

This number is satisfying until you ask a deeper question: How many years of retirement life will this income actually support? For most households, this concern is not receiving benefits. They need to know if those benefits can keep pace with longer lifespans and the rising living costs.

This article answers this question, explaining the actual meaning of 87% and why reliance is growing. It also covers the ways high-net-worth families can use this number to plan calmly and clearly. The goal is not to answer the value of Social Security. It is to place it in the proper context within a broader retirement strategy.

Decode The Actual Meaning Of This Magic Number 87%

The 87% reflects access and not adequacy. To uncover more hidden details, we need to go deeper. Access refers to all the benefits received, while adequacy measures those benefits and determines whether they are sufficient for a sustainable lifestyle.

Who Is Included In The 87%?

A report by the Social Security Administration states that nearly 9 out of 10 Americans above age 65 receive monthly benefits. This includes retirees across all income levels, from households with limited savings to those with substantial savings.

This just covers the necessities and not the comforts. Most of the recipients rely on Social Security as a supplement, while others depend on it as a primary or only source of income. We need to understand this distinction when we are interpreting retirement security figures. Without a clear idea, this 87% figure can create a false sense of financial readiness.

For high-net-worth families, this fund often covers baseline expenses. Discretionary spending depends on personal savings and investment income.

What Amount Of Retirement Income Comes From Social Security?

According to the Transamerica Institute Retirement Survey 2025, 32% of Americans expect Social Security as their primary source of income. Among the current retirees, this figure is higher. This reflects a growing dependence that is driven by longer retirements and uneven savings patterns.

Separately, the Social Security Administration notes that about 12% of the beneficiaries depend on Social Security for over 90% of their income. These figures tell us that social security optimization strategies are no longer optional. They have become essential for households that want to protect their lifestyle flexibility while reducing the long-term income risk.

These numbers were gathered from the data by Social Security Administration. You now know the retirement benefits and how they are calculated.

Red Flags The Trustees Are Warning Us About

The 2025 Social Security Trustees Report predicts that the combined OASDI trust fund will end in 2034 if no legislative changes are made. At that point, the continuing payroll taxes will cover approximately 81% of the scheduled benefits. This shortfall highlights the risk of timing rather than an immediate collapse.

A similar concern was raised in the NIRS report social security. Over there, it was clearly stated that delayed policy action increases income pressure on future retirees. This is especially appreciable for those without strong private savings buffers.

When planning, these warnings suggest preparing for partial adjustments rather than assuming full benefits indefinitely.

What Is Its Importance For High-Net-Worth Families?

For affluent families, Social Security often reflects a smaller share of total wealth. Still, this is a valuable and inflation-adjusted lifetime income stream. The risk is never to lose benefits entirely, but to overestimate the long-term purchasing power. The Employee Benefit Research Institute (EBRI) 2025 Retirement Confidence Survey shows that even higher-income households underestimate the longevity and healthcare costs. A mistake in the calculations can erode wealth over time. Therefore, you need to plan your retirement income wisely.

One of the standard approaches is building a retirement income bridge. It uses private assets in early retirement years to delay Social Security and strengthen guaranteed income later. This strategy allows families to manage tax exposure, smooth the cash flow, and preserve the optionality without overreacting to policy uncertainty. It also provides flexibility during market volatility. As a result, it allows families to avoid selling assets at unfavorable times.

Planning Practically Without Panicking

A calm strategy begins with clarity. Identify all the expenses that will be covered by guaranteed income and things you can flex. This difference allows households to prioritize security and still enjoy discretionary spending.

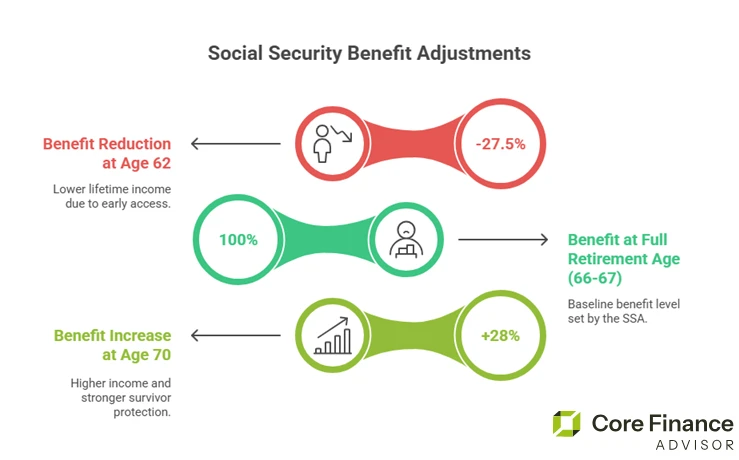

Most planners now stress-test retirement plans using scenarios with a reduced Social Security payout. Still, they evaluate the long-term impact of claiming benefits at 70. This is a move that can materially increase lifetime monthly income and survivor protection for households with longevity on their side. The goal is not to predict outcomes. It is to prepare for multiple possibilities with confidence.

Final Word- Turn All Your Data Into Direction

This 87% magic number tells us that Social Security is widespread. It is not sufficient on its own. Whether it is trustee projections, retirement surveys, or confidence studies, they all conclude at the same point. They claim that reliance without planning creates vulnerability.

For high-net-worth families, the solution is not fear-driven action but informed decision. They need to use Social Security as the foundation and not a guarantee. Stress-test assumptions will align with the income and essential needs. Bring changes as the policy changes.