TLDR:

- Americans are reported to say they now need $1.26 million for a comfortable retirement, to live longer, and maintain their lifestyle.

- Today, inflation has slowed, but many people still don’t save enough, underestimating the importance of starting early and saving regularly over time.

- Wealthy families use this number to help plan their finances, not as an amount they must reach. Their goal is to focus instead on steady, personalized investment growth.

In 2025, you can view recruitment planning from a new angle, and Americans have redefined what it means to retire comfortably. According to the 2025 Planning & Progress Study by Northwestern Mutual, adults across the US need $1.26 million for a comfortable retirement. This figure is widely discussed as the Year’s Magic Number.

This blog discusses the depth behind Americans’ demand of $1.26 Mn to retire and why it has become their long-term financial strategy.

The Story Behind $1.26Mns

Recently, a comprehensive study with 4,600 US adults as the sample size was conducted. They were simply asked how much money people need to retire comfortably. The answer was $1.26 million. The participants said that this amount is enough to cover everyday living costs after retirement.

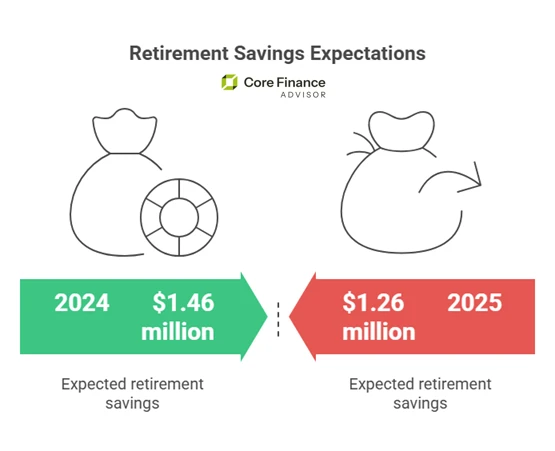

The study showed a clear retirement savings gap between what people expect to have saved and what they actually have. However, when the same study was conducted in 2024, the expectations people have today was about $200,000 greater than what they say today. The figure was $1.46 million in 2024.

Why Their Expectations Dropped to $1.26 Million

The drop in this figure shows the drop in expectations as inflation slows. But a definite expected figure for inflation-adjusted retirement planning is still there.

Several economic forces have influenced how Americans think about retirement savings. Inflation is one of the biggest reasons. As the inflation rate has declined, retirement expectations have become more realistic. This change means today’s estimates are now more in line with what people thought they would need back in 2022 and 2023.

People today also expect to live longer than earlier generations. That’s another reason they desire more savings to cover their living expenses.

How Americans Plan for Retirement at Different Life Stages

Younger people such as early Gen Zs and Late Millennials feel more prepared for retirement because they start saving earlier. Older adults, mostly Gen X, are playing catch-up. They have to save faster now because they didn’t have the chance to save enough earlier in their careers.

Most of the individuals in that group entered the workforce during economic downturns. They managed higher housing and education costs. As a result, a large portion of Gen X has saved only a few times their annual income, leaving them closer to retirement with insufficient savings. This is also a pattern observed in the Northwestern Mutual study 2024.

Investors and advisors also need to understand how different generations approach retirement. There’s no one-size-fits-all plan. Strategies should be customized based on a person’s age, career stage, and the economic environment.

That’s why Core Finance Advisor works with investors to turn these generational dynamics into personalized retirement plans that make sense for each individual.

Why Social Security Alone Isn’t Enough for Americans’ Retirement

When evaluating retirement goals, Americans see Social Security as a safety net. The Social Security system provides essential support for millions of retirees. However, long-term funding concerns and benefit limits mean most households need additional income.

For wealthier families, Social Security is usually secondary, with investments, rental properties, or business income playing a key role. Striking the right balance between these income sources is essential for managing both liquid assets and overall net worth.

Why Many Americans Are Falling Short of Retirement Savings Goals

Even when Americans aim to save a lot, most are still far from their retirement goals. Gen X especially or those aged 45 to 60 have only a few hundred thousand saved, which is far below than their expected comfortable retirement amount of $1.26 million. The primary reason behind this is them having to face economic pressures, high living costs, and reduced pensions. Gen Z is just starting out but generally saves earlier and faster than others, though their total savings remain low because they’re younger.

Strategies Used By Wealthier Retirees

The high-net-worth families approach the retirement plan with a different strategy.

- Diversification: They spread investments across stocks, bonds, and real estate to reduce risk while supporting long-term growth.

- Tax Planning: Using tax-efficient withdrawals and charitable giving helps lower taxes over time.

- Estate Planning: They ensure wealth passes smoothly to heirs, minimizes taxes, and reflects personal values.

- Insurance: They believe in long-term care and other coverage to protect against unexpected expenses that could threaten savings.

Core Finance Advisor helps translate these strategies into practical, personalized plans so every client can protect and grow their wealth confidently.

Final Words

The recurring idea that Americans need $1.26 million to retire comfortably reflects changing economic conditions and personal expectations. This number is helpful, but the actual retirement depends on how you align financial resources with individual goals and life stages.

It is observed that wealthier individuals benefit the most from personalized strategies. They prefer smart investments, tax-efficient strategies, and risk management. This is essential in a changing market, where priorities are game-changers.