If you’ve ever caught yourself wondering, “I’m paying these advisor fees, am I actually getting value?” you’re not alone. In 2026, that question is more relevant than ever.

With AI tools, transparent fee structures, and DIY apps, the question is whether financial advisors are justified anymore. Others have wonderful experiences with their advisors who have assisted them to increase wealth and others believe that the fees are not worth it. The quality of advice you receive will determine whether you need one or not based on your objectives.

An advisor assists you in making better decisions, saving more taxes and being sure about your money whereas a bad one will cannibalize your returns.

Understanding Financial Advisor Costs in 2026

The three main types of financial advisor fees are AUM-based, flat, or hourly. Knowing which one fits your situation helps you decide if an advisor’s cost is worth it.

1) AUM Fees (Percentage of Assets Under Management)

This remains the most widespread form of charging by advisors. They typically charge 0.8-1.2 % annually on the amount of money they invest on behalf of you. For example, at an investment of $500, 000, you may be paying approximately 5,000 annually. Other new companies are cheaper, about 0.5% or less, particularly when you employ robots-advisors or receive less planning.

2) Flat (Subscription or Project-Based) Fees

A large number of these fiduciary planners charge a set fee of $2,000 to $10,000 per year or per month depending on the complexity of your finances. This is gaining popularity in younger investors and business owners who desire honest advice without having to worry about the size of their investment portfolio.

3) Hourly Fees

In case you require one time assistance like a retirement plan or tax strategy, most advisors will provide their services on an hourly basis, this is normally between $150 to 500, depending on their experience and qualification. The model is suitable to those individuals who like to do their own investing but have a professional advise them on particular decisions or financial check-ups occasionally.

The charges could be perceived to be high but a good advisor could be worth that money as they could assist you in making a more rational emotional choice, optimize tax advantages, align your portfolio with your goals, and remind you to be on track. They are in fact giving the confidence and peace of mind and not just the returns they receive.

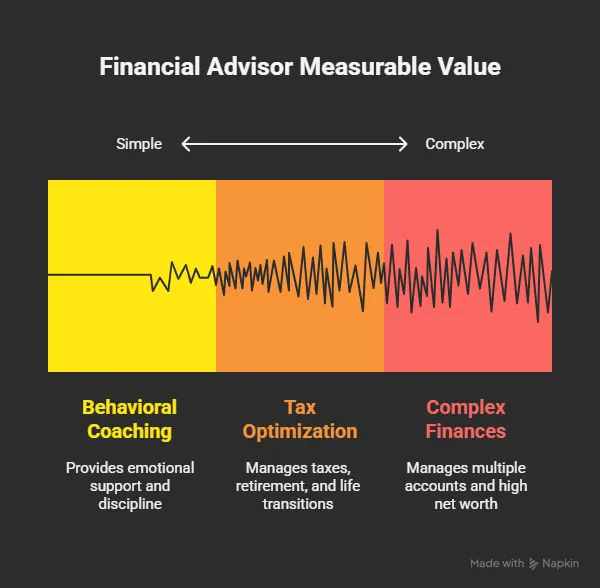

When a Financial Advisor Adds Measurable Value

When asking if financial advisors are worth it, the answer depends on when and how they add value. The real financial advisor cost vs benefit comes down to how much time, stress, and money they save you compared to their fees. In most instances, a good advisor can make a meaningful difference both financially and emotionally.

1) Behavioural Coaching & Staying the Course

One big hidden benefit of a good advisor is behavioral coaching, helping you stay calm when markets drop and avoid risky trends. Research from Russell Investments in 2025 showed advisors can add about 4.87% in value, mostly by preventing emotional mistakes, managing assets wisely, planning taxes smartly, and creating personalized strategies.

A blog from Nitrogen Wealth found that around 40% of clients say an advisor’s main value is emotional, someone who helps them stay calm and disciplined when markets get noisy.

Why this matters in 2026: With markets changing fast, inflation rising, and more people investing on their own, it’s easy to make rushed decisions. A good advisor helps you stay focused on your plan instead of reacting to every headline, guiding you on what not to do as much as what to do.

2) Tax Optimization, Retirement Withdrawal Strategy & Life-Transitions

Beyond investing, a financial advisor adds real value during major life changes, buying a home, switching jobs, starting or selling a business, receiving an inheritance, or planning for retirement.

For example:

- They can guide you on tax-efficient retirement withdrawals, Social Security timing, Roth conversions, and estate planning.

- They help balance growth and risk, especially if you’re 10–15 years from retirement and want to protect your lifestyle.

- They also ensure your wealth transfers smoothly to family, preventing unnecessary losses.

Research from The American College shows that clients often value full financial planning, taxes, estate, and retirement income, more than just investment choices.

In short: When you have more than just an investment in play, it is not just a goal, but life transitions and tax, retirement, and estate planning that you need to consider and manage, then this is where an advisor can be of real, quantifiable benefit.

3) Complex Finances & High-Net-Worth Scenarios

Many DIY investors do well, but at some point, finances get complex enough to benefit from professional help. Signs you’ve reached that point include:

- You have several accounts (401(k), IRA, brokerage, rental property) and find it hard to manage them together.

- You have over $250,000 in assets, and mistakes can be costly.

- You’ve had a major life change, inheritance, divorce, business sale, second marriage, or nearing retirement.

- You don’t enjoy or dont have time for investing, or emotions often drive your money decisions.

In these cases, an advisor isn’t just helpful, they can be a real difference-maker. One Russell study indicates that value is added in such areas as smart asset allocation, behavioral coaching, personalized planning, and tax-efficient investing all of which contribute to your total returns.

4) Case Examples (Anonymized)

The examples show that value is determined by the complexity of your situation, the degree of coordination you require and the extent to which you would like to manage yourself.

Case A

Maya, 38, is a startup founder whose investments of 700k and business revenues are on the rise. She had a desire to expand her business and accumulate personal wealth. She has been able to put her finances in order, establish a retirement plan with her team, and develop a tax-saving plan to sell stocks in the future with the help of an advisor.

Cost: ~0.8% of assets managed.

Benefit: Lower taxes, less stress, and clear long-term goals.

Case B

Omar, 29, is a tech employee who has saved 150k and stock options with the company. He does the majority of investments himself but uses an advisor on more complicated transactions such as stock vesting or home purchase.

Cost: About $300/hour when needed.

Benefit: Keeps control, saves on fees, and still gets expert help when it counts.

When You Might Not Need a Financial Advisor

Not everyone needs a financial advisor, and that’s okay. In 2026, with AI tools, robo-advisors, and easy investing resources, it’s possible to leave most of the work to managing oneself, particularly when the complexity of their finances is low, and the fees of an advisor do not provide sufficient value.

So, when your finances are not complex, then you might not need one. However, when you have several goals, tax, or family issues to manage, it can be worth hiring a financial advisor who can coordinate everything and help you make confident, well-planned decisions.

You Have Simple Finances and a Clear Plan

When you have straight forward goals, such as debt repayment, retirement savings, and index fund investments, you can likely manage without a full-time advisor. Platforms like Vanguard Personal Investor, Fidelity’s Goal Planner, and Betterment can automate and balance your investments for a much lower cost than the usual 1% advisor fee, meaning hiring one might actually reduce your returns instead of increasing them.

You’re Comfortable Managing Your Money and Enjoy It

DIY investors who know the basics of diversification, risk control, and tax-saving strategies can often manage well on their own using trusted sites like Morningstar, Bogleheads, or Investopedia. As one Redditor put it, if you enjoy learning about money and stay calm during market swings, paying 1% yearly for what you can do yourself doesn’t make sense. Peace of mind is the primary benefit of an advisor to such people, and once they have it, they may not need to pay.

You’re Early in Your Wealth-Building Journey

When you are starting to invest, need to establish an emergency fund, open a Roth IRA, or contribute to your 401(k), you should save more than pay advisor fees. A simple, low-cost ETF portfolio can grow well on its own, and you can always hire an advisor later when your finances become more complex, like managing multiple accounts, real estate, or retirement income.

You Only Need Guidance for Specific Questions

Sometimes it’s smarter to hire an advisor for a one-time session instead of paying yearly fees. You can get expert help for things like reviewing stock compensation, planning for retirement, or making big decisions like buying property or starting a business. Many fee-only fiduciary advisors on networks like XY Planning Network or NAPFA offer hourly or project-based services, giving you expert advice without ongoing costs.

You’re Using Technology Strategically

The most promising opportunity in 2026 is hybrid financial planning, which is a combination of AI-based investing and optional human advice, which provides an investor with the best of both worlds. Platforms like Empower, Facet, and Schwab Intelligent Portfolios Premium let you access CFP® professionals when needed while AI manages your portfolio and cash flow. For many people, this is the ideal balance between full-service help and DIY investing.

Find Out If You Actually Need an Advisor

If you’re still not sure if a financial advisor is worth it for you, get a personalized breakdown of when professional advice makes sense, and when you can confidently go solo. Talk to a fiduciary advisor today

Are Financial Advisors Worth It in 2026?

If you have multiple accounts, business income, tax concerns, or major life changes, a fiduciary advisor can be worth it, not just for returns, but for smart tax planning, discipline, and peace of mind.

However, in case you have simple finances and are sure you can handle them, low-cost robo-advisors, AI-based tools, or hourly CFP assistance may suffice. As of 2026, the majority of advisors will be charging between 0.8%-1% of assets, but flat and hourly fees are on the rise.

The real test is whether your advisor saves you money, time, and stress. When their contribution in terms of numbers or confidence is greater than the cost, then they are worth retaining.

In the end, the best advisor relationship in 2026 is open, informed, and truly personalized, whether human, hybrid, or AI-powered.

FAQs

How do I know if I’m getting value from a financial advisor?

When you do not know the reason why you are paying them, then that is a red flag. A good advisor will demonstrate how his or her work will help you achieve your objectives, such as saving taxes or even be able to improve your retirement plan, and it will be transparent in relation to charges.

When should I consider hiring a professional?

You need some help when your finances become complicated, such as when you need to manage more than one account, tax choices, or when you approach retirement. When things are simple, you may probably be left to manage alone.

Is a 1% AUM fee too much?

It will depend on what you are getting. Normal is about 0.8-1.0%, but ensure that the results of the solution, which include reduced errors, tax-savings or a better plan, is worth the price.

What if I only need help sometimes?

You may pay advisors on an hourly basis or on a project basis such as when opening a business or handling an inheritance. Good choice when you do not want to pay an expert because of constant fees.

Can an advisor help if I feel anxious about money?

Yes. Advisors are able to offer emotional assistance and guide you to remain calm in good times and bad times within the market. Their advice is worth it just in peace of mind.

How do I find a trustworthy advisor?

Select a fiduciary (one who is legally obliged to act in your best interest), is fee-clear and simplifies things. Trust your gut, a good counselor must leave you with no doubts but with a lot of confidence.