Key Takeaways

Here’s a quick overview of what the tax update in 2025 will mean to your money in 2026.

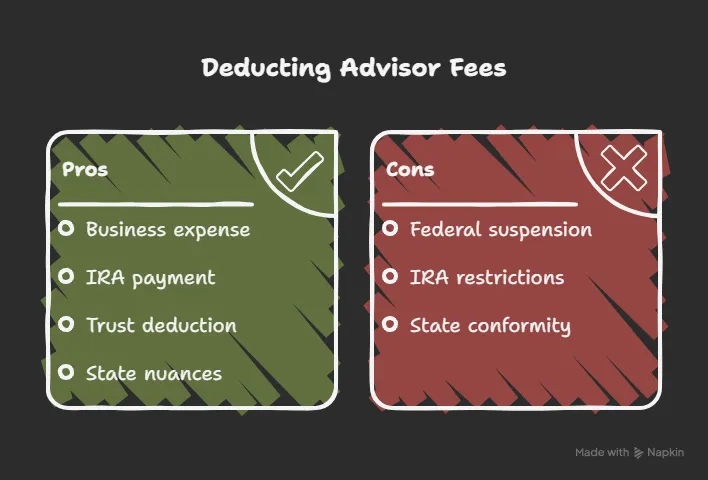

- Most people still can’t deduct financial advisor fees from their federal taxes.

- Self-employed or business owners may deduct fees tied directly to business income.

- Paying advisor fees from a Traditional IRA can be tax-efficient since it uses pre-tax money.

- Trusts and estates may still deduct management fees related to their operations.

- State tax laws differ, so check with a local tax expert or CPA for specific rules.

In 2025, most people still can’t deduct financial advisor fees on their taxes. The rule that removed this tax break in 2018 is still in place because Congress decided to extend it. So, if you pay for investment or financial planning advice, those costs usually aren’t tax-deductible. Only a few special cases, like certain business or trust expenses, still qualify for a deduction.

In this guide, we’ll break down exactly where things stand, what could change in 2026, and the few situations where you might still qualify for an IRS advisor fee deduction today.

When Financial Advisor Fees Were Tax-Deductible

Before 2018, individuals were allowed to deduct financial advisor fees on their taxes, but they had to satisfy some requirements. These expenses were included in what the IRS termed as miscellaneous itemized deductions on Schedule A.

You could deduct it, however, only the amount over 2% of your adjusted gross income (AGI) of the amount you paid in the form of portfolio management, investment advice, or tax preparation. To illustrate, some examples are that in case your AGI was 100,000 and you paid 4,000 of these fees, you could only deduct 2,000 (the amount over 2,000, which is 2% of your income).

It is a rule that makes a few people or retirees with high advisory fees pay a little less tax. However, the majority of taxpayers did not gain a lot since:

- Many people used the standard deduction instead of itemizing.

- The 2% rule made it hard to claim a large enough deduction.

These miscellaneous itemized deductions were then eliminated by the Tax Cuts and Jobs Act of 2017 beginning with the 2018 tax year. This implies that it is no more to the pocket of most individuals to pay a financial advisor at this point in their life, not even a tax deductible expense.

Hopefully, these deductions would be restored in 2026, but with the extension of Congress in 2025, it is now improbable.

Why Most Fees Aren’t Deductible (and What Might Change in 2026)

If you have ever asked can I deduct financial advisor fees on my taxes, the simple answer for most people today is no. Here is why that is and what might change in 2026.

Why Fees Are Generally Not Deductible Now

Due to the present federal taxation policy, the personal investment advisory deduction cannot be used by the majority of investors. Prior to the Tax Cuts and Jobs Act of 2017 (TCJA), taxpayers were allowed to claim a deduction of some expenses under Internal Revenue Code section 212(a) dealing with the production or collection of income. This regulation enabled deduction of some of the financial advisor fees as long as they were related to management or maintenance of investments.

However, the TCJA also postponed miscellaneous itemized deductions, which were the deductions only available on expenses that exceeded 2% of your adjusted gross income (AGI). A large number of fees charged by financial advisors fell under this category and therefore they are no longer deductible. As a result:

- If you’re a typical individual investor using an advisor for portfolio management or retirement planning, your fees are not deductible.

- Because most taxpayers take the standard deduction rather than itemizing, this change has practical impact for a large portion of taxpayers.

- The IRS clearly states that expenses for investment advice or financial planning are among those that are no longer deductible for individual taxpayers.

What Could Change in 2026

Consequently, most individual taxpayers continue to bear the suspension of miscellaneous itemized deductions, under which the fees of financial advisors used to be eligible, until October 2025. The TCJA initially came along with a number of temporary provisions, which were expected to expire by the year 2025, but Congress chose to extend or make permanent a number of them in mid-2025.

The IRS Publication 529 states that people are not allowed to deduct investment advice and portfolio management fees at the moment. There remain some exceptions (see below), however, as a rule, advisory fees should be regarded as personal expenses which are not deductible.

(Sources: IRS Publication 529; Kiplinger, “2025 Tax Bill Extends Key TCJA Provisions”)

However, do not rely on that yet. Lawmakers might extend or permanently change the law, but until they do, the current rules remain in place.

Why it Matters For You

These tax rules are important to know since they influence budget and tax planning. Many people still ask are financial advisor fees tax deductible because it affects how they plan their budgets and investments. Financial advisor fees do not tend to reduce the taxable income of most people, as many would assume, and it can alter the way you estimate the real cost of financial advice. Going forward to 2026, you can be prepared ahead of time by monitoring possible changes in the law.

When You Can Deduct Advisor Fees (and Smart Alternatives)

Even though most investors can’t currently deduct financial advisor fees on taxes, there are still a few niche situations and strategic workarounds where your advisory costs may indirectly reduce your taxable income. Here’s how those exceptions play out.

1) If You’re Self-Employed or Run a Business

In the case of self-employed individuals, financial management charges based on business revenues can be treated as regular and required costs of business according to the IRS Code 162. This implies that in case you hire a financial professional to handle your retirement accounts, business cash flow, or investments related to your Schedule C, you can deduct such expenses as business-related rather than personal.

For example, a consultant who hires an advisor to plan SEP-IRA contributions or manage business cash reserves could deduct part of that fee as a business expense.

2) If Fees Are Paid Directly from an IRA or Retirement Account

The other option that can be considered is paying the advisory fees using a tax-advantaged account, such as a Traditional IRA. When you pay the fee using the IRA money rather than your own money, this is a pre-tax amount, which reduces the balance of the IRA but does not constitute a taxable withdrawal.

However, this only works if the fee is for that specific IRA. If it covers multiple accounts or your overall portfolio, it can’t be taken out tax-free.

3) Trusts and Estates: The Big Exception

The rules of trusts and estates are different. This is still deductible under Treasury Regulations, 1.67-4 and IRS Publication, 529, under the condition that the investment management or fiduciary fees are unique to the management of the trust or estate, i.e. they would not exist had the assets been held by an individual.

These can include fiduciary and trustee fees, appraisal costs to find fair market value at death or for distributions, and special investment advisory fees tied to the trust’s setup. This rule can be helpful for high-net-worth families managing inherited assets.

4) State-Specific Nuances: California and Others

There are states such as California which are not strictly adhering to federal tax laws. California did not embrace everything on the TCJA, therefore, tax regulations in the state may vary. Although it generally conforms to federal suspension of miscellaneous deductions, refer to the California Franchise Tax Board (FTB) or a tax professional to get the most current 2026 regulations. California has revised its conformity date to January 1, 2025, as of 2025 (SB-711).

However, it has not adopted parts of the 2025 federal tax package, so state rules on itemized deductions may vary. Always confirm with the FTB or your state tax agency for the latest guidance on financial advisor fee deductions.

(Reference: California SB-711 + FTB guidance)

5) Other Smart Tax Moves While You Wait for 2026

Although you are not able to deduct financial advisor charges with the IRS at the present time, you can still cleverly reduce on your taxes and make your money business more profitable:

- Use investment losses to offset capital gains (up to $3,000 each year).

- Deduct investment interest from margin loans used to buy taxable investments.

- Contribute the maximum amount to tax-advantaged accounts like Traditional IRAs, Solo 401(k)s, or HSAs.

- Donate appreciated assets instead of cash to get charitable deductions and avoid capital gains tax.

These steps don’t make your advisor fees deductible, but can assist you in achieving the same objective as maximizing your after tax returns by minimizing taxable income.

What to Expect in 2026: Post-TCJA Scenarios & Planning Ahead

The Tax Cuts and Jobs Act (TCJA) put a hold on the deduction of fees charged by financial advisors beginning in 2018 and the Congress renewed the rule in 2025, maintaining it after 2026. IGRS Publication 529 provides that such fees are not tax-deductible to individuals, except in special circumstances such as business-related expenses (IRS Code §162), fees paid by an IRA, and in some cases trust fees (Treasury Regulations §1.67-4).

It may vary with state regulations, like in California. Given that deductions are not expected to come back in the near future, concentrate on other tax-saving plans such as contributing to retirement to the maximum, harvesting losses, or giving away appreciated assets.

Not Sure How These Rules Affect Your Portfolio or Business Taxes?

Our advisors can help you structure your investments and fees in a tax-efficient way for 2026 and beyond. Book a Free 15-Minute Consultation

FAQs

If I paid $4,500 to my financial advisor, can I write that off this year?

No. Most people can’t deduct financial advisor fees on their federal taxes right now because the law still blocks these deductions.

I run a business on the side, and my advisor helps me with both business and personal investments. Can part of the fee be deductible?

Yes. The part of the fee that’s clearly for your business, like retirement plans or business advice, may count as a business expense if you have proof.

Does paying my advisor out of my Traditional IRA change the tax treatment?

It can. If the fee is paid directly from your IRA for managing that IRA, you’re using pre-tax money. It’s not deductible, but it’s still tax-efficient.

What if I live in a state like California, could I still deduct advisor fees on my state return?

Maybe. Some states have different rules. California, for example, doesn’t always follow federal law. Check with your state tax office or a local tax expert.

Will this change soon, or in 2026, so I should keep my advisor fee receipts?

Not likely soon. The 2025 law extended the current rules. Still, keeping your receipts is smart in case the rules change later.

I’m annoyed I can’t deduct the fee. Does that mean paying an advisor isn’t worth it?

Not at all. Even without a deduction, a good advisor can help you invest smarter, lower taxes in other ways, and avoid costly mistakes, which can save you money overall.

Are financial advisor fees tax deductible in 2026?

No. Unless Congress changes the law again, financial advisor fees will still not be deductible for the 2026 tax year.