You’ve grown attached to your leased car – but before walking away, have you checked if buying it might actually save you money? Yes, that is possible. A lease buyout sometimes results in lower purchase prices of the car, giving you the opportunity to own and drive your favorite car at a comparatively lower price than the market.

If you have a leased car and are planning to buy it, you may need a proper lease buyout plan so that you can negotiate effectively with the seller. This blog explores different aspects of a lease buyout and explains what is the process of buying out a leased car and how to calculate car lease payment. By the end of this blog, you will be able to calculate your lease buyout – and who knows, maybe you’d actually buy your favorite car.

What is a Lease Buyout?

A lease buyout refers to the process of buying your leased car from the seller at the residual price mentioned in the agreement. You have two options – either buy the car at the end of the lease, or if you like the car very much, you can buy it at the start of the lease. Both options provide you with benefits, but an early lease buyout is preferred more.

Buying your leased car can be really beneficial for you, as you already know the car inside out, so there are no hidden malfunctions.

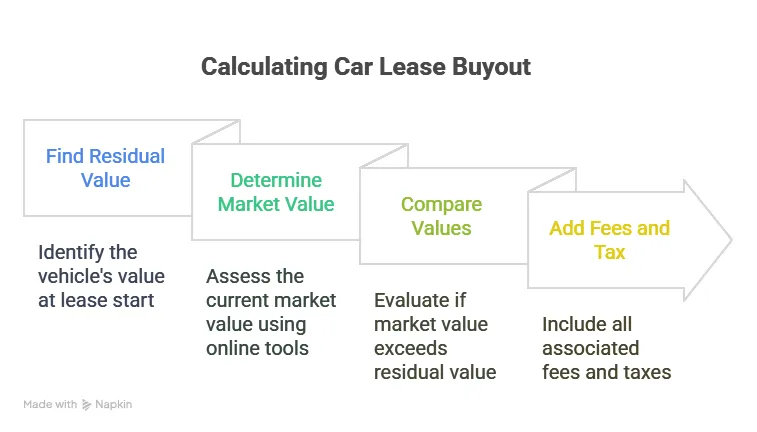

Step-by-Step: How to Calculate Car Lease Payment

Now, answering the question, “What is the process of buying out a leased car?”. Calculating a car lease buyout is really simple and can be done through the steps given below.

Step 1: Find the Residual Value

- Residual value is the value of the vehicle determined at the start of the lease by the seller. It is listed in your lease agreement or monthly statement.

Step 2: Determine the Current Market Value

- You can use different online tools like Kelly Blue Book or consult with car dealers to determine the latest market value of your leased car.

Step 3: Compare Residual Value vs. Market Value

- If the market value is less than the residual value, then the lease buyout is good for you.

- If the market value is greater than the residual value, then the lease buyout isn’t that profitable for you; however, it might still make sense considering the extra fees avoided.

Step 4: Add Associated Fees and Tax

- Once you’ve gotten the actual value, i.e, the residual value, add up other fees like purchase option fees, licensing, registration, and sales tax. Also include the outstanding lease amount if listed as “payoff amount”.

Calculating Your Lease Buyout: A Simple Example

If you’ve followed the steps but are still confused about how to calculate car lease payment, the example given below will clear all clouds of doubt and confusion. We have created a simple scenario to demonstrate how a lease buyout works.

Now, Imagine:

- Residual value of your leased car: $18,000

- Market value: $20,000 – Since the market value is greater than your residual value, buying the leased car is a smart choice.

- Add fees and taxes (for example, $1,200) to the residual value.

- Total buyout cost: $19,200.

In this scenario, you saved $800 by buying your leased car instead of purchasing a comparable new car from the market.

How Much Is It to Buy Out a Lease: Fees & Timing Tips

We know it is the main concern to know how much is it to buy out a lease car. The price of the leased car mostly depends on the residual value, as it is pre-decided, with the additional costs adding up to that amount. However, there are a few tips through which you can negotiate a better price for your lease buyout.

End-of-Lease Fees You Might Avoid

- Excess Mileage Fees: It can be $0.10–$0.30/mile, and sometimes costlier than buying the car.

- Wear-and-tear Charges: You can easily avoid the wear-and-tear charges you’d have to pay at the end of the lease by buying the car.

Early vs. Lease-End Buyout

- End Lease Buyout: You may get a better negotiation deal if you buy at the end of the lease, as the dealers prefer selling over repossession.

- Early Lease Buyout: Buying the car at the start of the lease may often result in less negotiation leverage and may include early termination fees.

Beyond the Numbers: Personal & Financial Benefits

Lease Buyout isn’t just about getting the car you want at a low price – it’s definitely more than that. If you look beyond the pricing, you’ll see many other benefits. Let’s explore a few!

- You’ve been driving the car for a while, so you know its condition inside and out, and if there are any issues.

- Through a lease buyout, you can avoid the hassle of finding a new car, visiting dealers and showrooms, and negotiating prices.

- Turning your leased car into yours offers peace of mind—no impending return penalties.

Conclusion

A lease buyout shouldn’t feel overwhelming once you’ve understood the numbers. By comparing your residual value with the market value, and adding up taxes to the amount, you can determine whether buying your leased car is worth it or not. In many cases, it can bring you lots of benefits, including lower prices, better negotiation options, peace of mind, and, of course – Your trusted car!

Before finalizing, always review your calculations, market value, and the lease agreement. This blog explored various aspects of a lease buyout, its process, how to calculate it, and extra tips for your ease. With the right calculations, you’ll have clarity to choose between returning the car or making it yours for good.

For more financial insights, tips, and services, follow and contact Core Finance Advisor – your trusted partner to upscale your financial growth.