Suppose you are a freelancer, offering graphic design services. Everything is going well and the business is running smoothly as well, until a single client decides to sue you after a disagreement. Now, in this case, your personal assets, including your house, car, and personal savings, are at stake. That’s the hidden danger of running a sole proprietorship business: no wall between business and personal assets. The solution? Forming an LLC (Limited Liability Company) from the start, or you can simply change sole proprietorship to LLC. It’s not just paperwork—it’s a smarter, safer way to grow.

An LLC is a legal business structure that combines the elements of partnerships and corporations, helping entrepreneurs run businesses without any hassle by keeping personal and business assets separate. In this guide, we’ll walk you through the process of how to change sole proprietorship to LLC and its key factors, along with the cost to change sole proprietorship. Let’s get started!

Why Change Sole Proprietorship to LLC – Top Benefits

Switching sole proprietorship to LLC is a big step and is highly beneficial. Though it may require some serious paperwork and effort, it’s going to be worth it. From having a risk-free business to paying less or sometimes no income tax, the benefits are endless. Let’s explore!

Personal Liability Protection

Unlike a sole proprietorship, where you, yourself, are the business, an LLC is a combination of different people who run different business operations. To change sole proprietorship to LLC can be highly rewarding, as the LLC structure keeps your business assets and personal assets separate from each other, allowing you to protect your personal assets from business loss or debts.

Growth Potential & Credibility

When you started your freelance or self-work, you must’ve faced some difficulty in proving your credibility to new clients. That’s because people trust verified businesses rather than individuals offering the same services as that business. So, switching sole proprietorship to LLC can help you build trust with your clients and scale your growth.

Tax Flexibility

As mentioned above as well, an LLC has to pay really low or sometimes no income tax in some US states, giving this business structure an edge over other structures. If you change sole proprietorship to LLC, you can choose between an S Corp and a C Corp to plan and decide your tax strategy, ownership goals, and business growth plans.

*S Corp: A corporation with limited liability and separate taxation.

*C Corp: A corporation with pass-through taxation and limited shareholders.

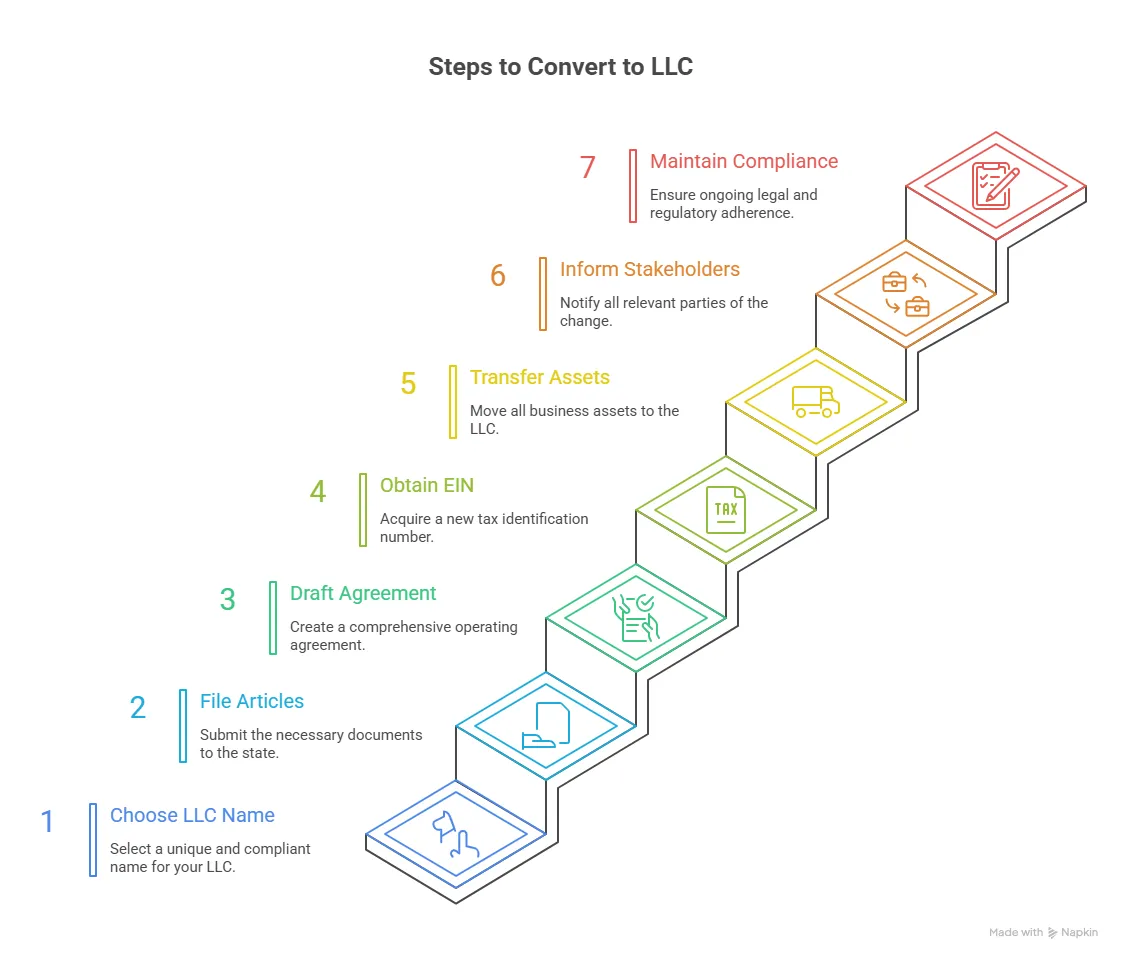

A Proper Guide to Change Sole Proprietorship to LLC

After learning those lucrative benefits of changing sole proprietorship to LLC, you would really want to create one now. To help you with the procedure, we have provided this guide explaining how to change sole proprietorship to LLC.

Choose & Secure Your LLC Name

Once you’ve decided to change sole proprietorship to LLC, the first step is to choose a unique name for your LLC. The name is the first thing the people, as well as the state, get to know about your business, so it should be different and represent your brand voice. Make sure that the name is not plagiarized, includes “LLC”, and doesn’t violate trademark or restricted words lists.

File Articles of Organization

Visit your Secretary of State’s website or equivalent business agency to download or file the articles online. You’ll typically need an LLC name, business address, registered agent information, and a business management structure, specifying whether the business is manager-managed or member-managed. It also includes a filing fee you have to pay, ranging from $40 to $500, depending on the state.

Draft an LLC Operating Agreement

An LLC operating agreement is usually overlooked; however, it is an equally important piece of documentation. This agreement includes ownership structure, profit and loss distribution, members’ roles and rights, LLC dissolving strategy, and other important aspects of the business. You must get an operating agreement drafted by a lawyer or professional company to avoid any issues and disputes later.

Obtain a New EIN

Before changing sole proprietorship to LLC, you must be using your SSN (Social Security Number) for taxes. So if you change sole proprietorship to LLC, your SSN won’t work now, and you’ll have to obtain a new EIN (Employee Identification Number) for tax purposes. Through this new identification number, the IRS will track and monitor your tax timeline. It is important to remember that even if you had an EIN as a sole proprietor, you’ll still need to get a new one.

Transfer Assets, Contracts, and Licenses

While changing your business from a sole proprietorship to LLC, it is important to transfer all your business assets, contracts, and licenses to the new LLC. If you have had a DBA (Do Business As) registered, cancel if necessary. Also, if you have any essential permits or licenses, get them renewed for this new LLC.

Inform Stakeholders & Update Finances

When you change sole proprietorship to LLC, don’t forget the final steps. Notify customers, suppliers, and insurers of the change, then open a dedicated LLC bank account for clean financial separation. Update business licenses and registrations accordingly, and if your state requires, publish a notice of LLC formation to stay fully compliant.

Maintain Compliance

After forming your LLC, ongoing compliance is key. File annual reports, pay state fees, and complete beneficial ownership filings on time. Don’t forget to renew business licenses regularly and track state-specific requirements like publication rules in NY, AZ, or NE. Staying updated with these obligations helps keep your LLC in good standing and legally protected.

To help you remember these core steps to change sole proprietorship to LLC, we have created this fun and easy mnemonic you can easily learn.

- F – File Articles of Organization

- A – Adopt an Operating Agreement

- C – Choose and secure your LLC name

- T – Transfer assets, contracts, and licenses

- O – Obtain a new EIN

- R – Register finances & notify stakeholders

- S – Stay compliant (annual reports, fees, renewals)

This makes the process feel structured and easy to remember—you can recall “FACTORS” when thinking of the key factors to switch to an LLC.

What Is the Cost to Change Sole Proprietorship To LLC?

Now the question may arise, “What is the cost to change sole proprietorship to LLC?”, and we are here to answer that. Below, a table is given for you to compare and understand the cost to change sole proprietorship to LLC.

|

Cost Factor |

Details |

Estimated Range |

|

State Filing Fees |

Filing Articles of Organization with your state. | $40 – $500 (varies by state) |

|

Operating Agreement |

Not always required, but strongly recommended for liability protection. |

$50 – $200 (DIY) / $500+ (lawyer) |

|

Name Reservation (Optional) |

Reserving your LLC name in advance. |

$10 – $50 |

|

Publication Requirement |

Some states (NY, AZ, NE) require publishing notice in newspapers. |

$200 – $2,000 |

|

Annual/Biennial Reports |

Ongoing state compliance filings. |

$20 – $500 per year |

|

Business Licenses/Permits |

Updating or applying for local/state licenses under LLC. |

$50 – $400+ |

|

Professional Fees |

Hiring an attorney, accountant, or LLC service provider. |

$300 – $1,500+ |

|

EIN (Employer ID Number) |

Issued free by the IRS, required for your LLC. |

Free |

| Registered Agent Service | If you use a third-party registered agent. |

$100 – $300 per year |

Tips to Remember While Changing Sole Proprietorship to LLC

- Not an actual conversion: It is not a matter of simply flipping a switch when you change sole proprietorship to LLC. You are actually forming a brand-new LLC, where you are transferring your business, assets, contracts, and accounts. This is the part most entrepreneurs overlook, believing it happens automatically, but it has to be planned and written down.

- Tax recapture issues: When changing sole proprietorship to LLC, there may arise some tax problems. When the recapture is necessary, the losses that you have claimed above will be charged again. This can lead to certain unanticipated liabilities; therefore, it is highly recommended to consult a tax specialist before restructuring.

- State requirements vary: Each state has its own regulations in the process of LLC formation. Others, such as New York, Arizona, and Nebraska, need you to publish notices in newspapers. Others have specific naming rules or increased filing charges. These are the conditions that you should always be sure to check before proceeding with the state.

- Don’t skip the agreement: Although your state may not legally demand one, it is important to prepare an operating agreement. It strengthens the protection of liability, establishes a clear structure of ownership and management, and prevents internal conflicts – particularly in multi-member LLCs.

- Professional help: When converting your business, you can get lost in the process. Legal or tax advisors can assist you on more complicated issues like multi-member ownership, entity-level tax elections, or liability concerns. Experts will have you confident that your new LLC will be off on the right foot.

Conclusion

Converting a sole proprietorship to LLC isn’t just about paperwork – it’s about changing the whole business structure to protect your future. From shielding your personal assets to getting tax flexibility, the LLC structure gives you the benefit of running your business smoothly without high cost and a complex structure. While the cost to change sole proprietorship to LLC can vary from state to state, the long-term benefits are almost the same in every state.

Take your time and carefully plan your conversion, understand state-specific requirements, and, if needed, consult a professional who is experienced in these types of conversions. By making the switch now, you are not only saving your assets and the costs, but also giving your business a stronger foundation to grow.

Start Your LLC the Right Way with Core Finance Advisor

Core Finance Advisor makes LLC formation simple and stress-free. From filing Articles of Organization to preparing a professional operating agreement, our experts ensure your business is set up correctly from the start so you can focus on growth with confidence.