Choosing a financial advisor is essential, as this is the person who will be looking at your future. The hired person must understand the importance of your money, find a solution to your worries, and treat your dreams as their own.

Most of us hold back from getting someone on board because we don’t know who to trust and what to ask. This confusion leads to mistakes that cost us in the future. The truth is, the right choice will shape our financial future for decades, so you must choose wisely. Use this blog as a guide that breaks down everything in a friendly, practical manner so you can confidently make your selection.

7 Questions You Must Ask a Financial Advisor

While most of us can document our financial goals and research different types of advisors, very few of us EXACTLY know what to ask during the meeting.

1. What Are Your Qualifications and Certifications?

When you ask them about their certifications, that does not mean they are making a good impression on you. You are ensuring the person you will choose is competent, ethical, and committed to their work. Designations like CPA (Certified Public Planner), CFA (Chartered Financial Analyst), and CPA (Certified Public Accountant) indicate that the advisor has passed all required exams and maintains high professional standards.

A 2024 study on ethics in financial advising found that clients deeply value advisors who uphold their legal and moral obligation to act in the client’s best interest. Such ethical foundations are essential when building trust with someone for long-term financial decisions.

2. What Is Your Investment Philosophy?

Getting an answer on how to choose a financial advisor requires gathering basic information through questions.

All investors follow different investment approaches. Some will prefer long-term strategies, while others focus on growth or on hunting for market opportunities. The person you choose must use an approach that aligns with your comfort level and personal goals. When you ask this question, you can benefit in this manner.

- Will understand if their strategy can fit your risk tolerance.

- Reveals the way they behave in the changing market conditions.

- Highlights and helps you get an answer if your plan will be customized or based on a generic template.

3. How Will You Measure My Financial Progress?

A good advisor uses clear benchmarks, regular reports, and structured reviews to track your progress. Vague statements and guesswork are among the strongest signs of alarm. Ask this question and ensure that your growth will be measured using transparent, data-driven methods. You will get an idea of the way to receive all the updates. With all these details, you will stay aligned with your long-term plans.

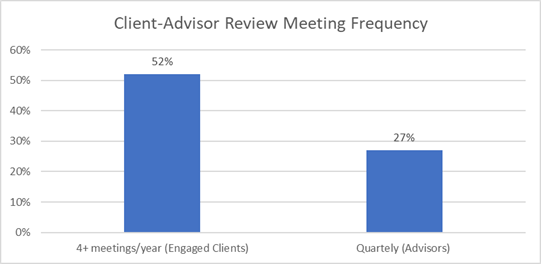

A report by Integrated LP found that 52% of engaged clients expected more than four meetings per year to review their financial plan. Another survey by WealthTech states that 27% of the advisors said the ideal frequency is quarterly.

4. Who Will Be Managing My Account?

At some firms, the person you meet initially will not be the one who will regularly manage your account. Inquiring before misunderstandings arise will prevent surprises. This will portray that you have understood all the rules and know the person who will be handling your investments. Can you calculate the importance of this question?

- You can confirm the person behind your daily financial decisions.

- It helps you evaluate the experience of the entire team, not just the salesperson.

- Removes all the communication gaps that can harm your connections when you need updates or any guidance.

5. How Do You Get Paid?

Among all the other questions, one of the questions to ask financial advisor is about the payment model they use. Your advisor’s payment model significantly influences your behaviour. Whether they are fee-only, commission-based, or a hybrid, how they earn money affects how their advice aligns with your interests. A peer-reviewed study of data from the National Financial Capability states that clients do not fully understand how their advisors are compensated, even when that compensation creates conflicts of interest.

| Advisor Type | What They Offer | Best For |

| Fee-Only Advisor | Unbiased advice, financial planning, retirement strategies, and investment management. No commissions. | People who want transparent guidance with zero sales pressure. |

| Commission-Based Advisor | Product recommendations (insurance, mutual funds), investment sales, bundled services. Earns commission per product sold. | Investors are comfortable buying financial products and want low upfront costs. |

| Fee-Based Advisor (Hybrid) | Mix of planning fees plus commission-based product offerings. More flexible service range. | Clients who want planning plus access to certain financial products. |

| Robo-Advisor | Automated portfolio management, low-cost investments, algorithm-based strategies. | Beginners, hands-off investors, or those seeking low fees. |

| Wealth Manager | High-level planning, tax strategy, estate planning, and investment management for complex portfolios. | High-net-worth individuals need advanced, personalized support. |

| Financial Planner | Budgeting help, retirement planning, savings strategy, and debt management. | Individuals who want a roadmap for achieving long-term financial goals. |

6. What Are the Services Being Offered Apart from The Investment Advice?

Many investors support more than just the investment. They entertain their clients with retirement planning, debt management, budgeting, insurance analysis, or estate planning. Upon asking this question, you will know if the services can grow with your needs. You can evaluate whether the advisor can offer comprehensive support, not just investment tips. You can get a sense of whether the person is encouraging long-term planning rather than short-term decisions. Till the last, before you get them, you can estimate the full value of this partnership.

7. What Happens If Something Does Not Go as Planned?

Even the best ones can make mistakes. You can always inquire about risk management, the complaint process, and how advisors will protect clients in the event of any misstep or market turmoil. Apart from this, you must verify if there is any disciplinary history. You can use two powerful tools for this:

FINRA BrokerCheck: This free service lets you check whether an advisor has a history of complaints or regulatory actions.

SEC’s Investment Advisor Public Disclosure (IAPD): A place where all the registered advisors’ registrations, disclosures, and any disciplinary history are documented.

Doing all the homework will protect you from ethical and regulatory risks.

Local Vs. Virtual: Which Advisor Style Is the Best Fit for You?

In the era of remote work and digital connectivity, you have more options than ever before. You can choose either a local in-person advisor or a virtual online advisor. Both of them have some pros and cons. You need to be smart to make a decision.

Different studies on financial literacy and robo-advising show that even digitally confident clients still value human connection. Although the virtual advisors cost less, they are flexible to communicate, and have access to all the niche specialists. The decision must depend on your personal style, how you receive advice, and whether you value relationship depth or convenience more.

Final Words: Inquire Before You Make a Decision

Choosing a financial advisor is a research-based decision. Asking about the qualifications, fee models, service range, disciplinary history, and the methods of measuring the progress, you can give yourself the chance to choose the right one. Use all the information and partner with someone who is genuinely aligned with your financial goals.

If you want someone with years of experience in the USA market, then CoreFinance is the best place. They have been working and serving their clients for more than 8 years. Get in touch with them and secure your future.