Key Takeaways

- Fee-based advice is now the industry standard, and 2026 will support this cause. Most advisors will move away from commissions to fee-based models.

- Fee-based does not always mean lower cost, so families must ask for clear fee breakdowns and written service details.

- Understanding how advisors are paid helps families choose advice that truly supports their long-term goals.

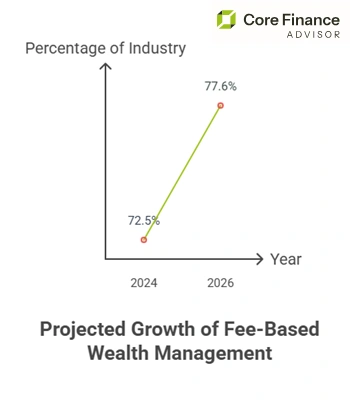

According to Cerulli Associates Advisor Trends, 2026 will be about 77.6% of advisors using fee-based models instead of commissions.

This shows that fee-based advice is no longer a trend in wealth management. It is becoming the standard. For high-net-worth families, this shift affects the costs, trust, and long-term financial planning. Advisors are moving towards a fiduciary standard 2026. They put the interest of the clients first rather than selling products.

This guide explains what is changing, why it matters, and the practical questions you need to ask your advisors.

Understanding The Shift From Commission To Fee-Based Advice

The industry has shifted from opaque fees to more transparent pricing. Clients expect to receive plain explanations, bundled planning, and few hidden sales incentives.

Advisors are supporting this cause and moving away from commission sales to asset-based and other fee arrangements. This transition is crucial for wealthy families, as it changes how values are measured and how long-term advice is delivered. This gets to the point that understanding fee-based vs commission advisor models is essential for anyone managing family wealth.

The Economics And Client Demands Insist On This Shift

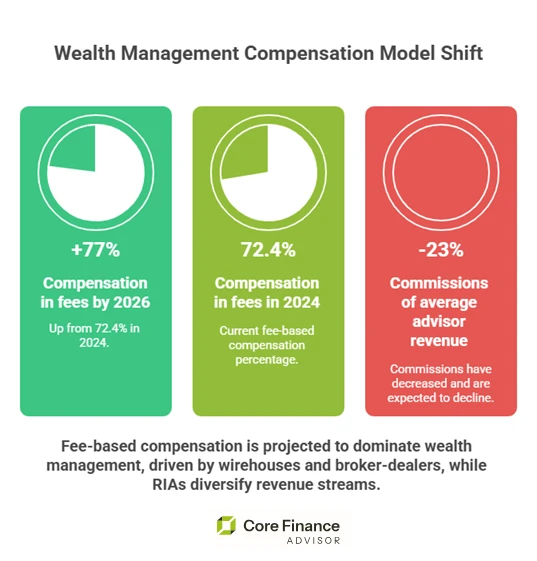

Several forces will push the change. These include regulation, technology, and the client’s preference for transparency. The asset-based fee scale, aligned with portfolio size, aligns advisor interests with client outcomes. Cerulli’s research reports that asset-based compensation accounts for about 72.4% of advisor pay today. In contrast, the commission revenue has dropped to 23% of an average advisor’s income.

All these figures highlight the distance the business models have shifted. This combination of economics and client demands explains the reasons firms are reorganized around relationships.

This graph is drawn using Cerulli Statistics, with particular emphasis on the fee-based shift.

What Does This Mean For Wealthy Families?

When fees are predicted in advance, families can plan cash flows and estate transfers more cleanly. Fee-based models often bundle planning services such as tax, estate, and retirement work within a single advisory relationship. Cerulli also reported that around 21% of advisors now just charge for financial plans. This signals a trend toward unbundled pricing for specialized planning services.

This aligns with the fiduciary standard 2026, focusing on advice that prioritizes the clients’ outcomes over product commissions. For high-net-worth families, it is an opportunity. It insists on a clear statement of services so that planning and investment management are not billed in a way that surprises future generations.

Ask Practical Questions And Evaluate Advisor Incentives

According to Planadviser, you must question the advisor about the amount they get paid and the number of times you need to pay them as a service charge. Inquire about the services that are included in the package you choose. Request for a sample and a clear breakdown of the services.

If you find the commission is still outstanding, ask them for full disclosure of the amount to avoid future conflicts. For families with concentrated positions, ask how they trade and whether they tax-loss harvest. A good advisor will welcome all these questions and provide you with written examples.

A Closer Look At Advisor Revenue Mixture

A clear understanding of the breakdown of advisor revenue today helps contextualize the shift.

Source: RIA growth statistics.

This chart demonstrates that most of the advisors are now primarily compensated through asset-based fees. In contrast, commissions and other sources constitute a smaller portion.

What Are These Changes Inside The Advisory Firms?

When advisors shift to fee-based models, firms must update how they bill clients and manage all accounts. They need to polish their skills to meet compliance rules. Some firms hire financial planners, tax experts, and estate specialists so that all services can be offered under one roof.

For most of the users, this means better and more consistent advice. However, it also means you are working with more than one individual rather than a single advisor. Make sure you know who handles each part of your plan and how many times you can meet with them to review.

Take A Step At A Time To Reach Your Goals

You can begin by writing down your advisor’s current pay and the services you are receiving. List down the three questions that you want to ask. If your advisor suggests a change in the fee structure, ask for a written explanation of how the commission products will be treated. Even inquire about future fees and how conflicts can be disclosed.

Remember, for complex trust or cross-border matters, you should always get a second opinion. Refer to Cerulli and PlanAdviser for the fee outlines. Then work on what to pay for and what services to add to the bucket list.

A Comparison That Can Help You

There are a few numbers you need to check that can make the advisor proposals easier to evaluate. Cerulli projects that about 77.6% of the wealth management industry uses fee-based models. This figure highlights that this has become a part of the norm.

Today, almost 72.4% of advisors derive their compensation from asset-based fees. In contrast, 23% are commission-based. These figures are a practical way to compare how different advisors are paid and how they align with your goals.

Red Flags Families Must Watch Out

Never assume that fee-based advice is always cheaper or free from conflicts. Asset-based fees include trading or platform costs. The flat planning fees might not cover tax or estate work.

Always ask about the execution fees and the custody charges. Also, confirm where your assets will be held and how reporting will work. Clear questions about all these details will show if the new fee structure really adds value.

The Next Step

Ask your advisor for a clear timeline when making changes or a sample invoice. You must even ask them to provide you with a written explanation of what the fee will cover. Request a side-by-side comparison of what you have paid for before and what you will pay in the future.

All agreed-upon pointers in writing, and plan a review meeting every six months. There, you can confirm whether the new arrangements are working and identify any changes that will be needed.

Final Words

This shift to fee-based advice is not temporary. It has become a lasting change that governs how financial advice works. Research from Cerulli shows that this move is gaining momentum and brings more transparent fees and better planning, leading to fewer conflicts.

For high-net-worth families, the next step is practical. Review your advisor’s pay and request clear explanations. You need to find out which services you will receive in the package you choose. And if your case is complex, don’t neglect the option of taking a second opinion.