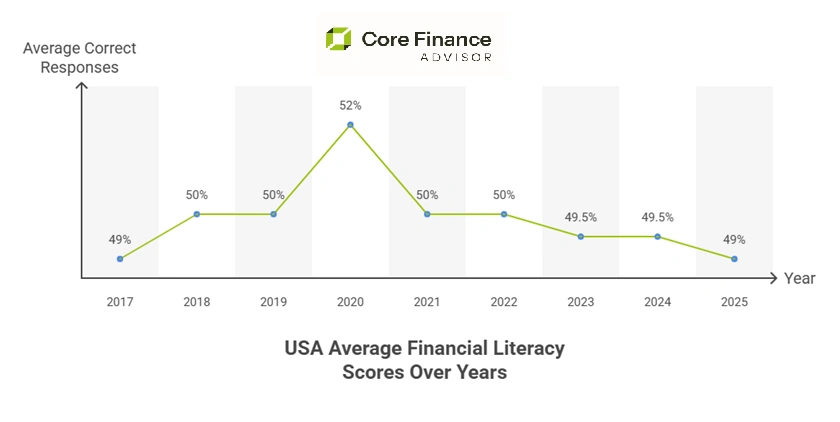

Financial literacy in the US has stopped improving. The results are the same for those adults who manage money regularly. Despite more financial education programs, the emergence of digital tools, and investment apps, Americans still answer only 49% of financial literacy questions correctly. According to Financial Literacy Statistics 2025, the results are the same as they were eight years ago.

This lack of progress is alarming for high-net-worth families, whose focus is on long-term and multi-generation planning. Gaps in understanding the risk and retirement plans can weaken their financial stability over time. This happens when they are viewed through the lens of financial capability vs literacy. Knowledge of how to address them is part of responsible financial planning.

Why Are There No Changes In The Scores

In 2025, the TIAA Institute-GFLEC Personal Finance Index surveyed 3,371 adults in the US to assess their knowledge in eight critical financial areas, as outlined in the TIAA GFLEC report. Despite years of awareness campaigns, the average correct response was 49%.

There was a problem with understanding, as answering risk-related questions correctly averaged 36%. These results highlight that knowledge acquisition alone is not enough. The practical application and structural guidance are equally important.

This table is based on data from the Financial Literacy and Retirement Fluency in America report:

The Real Gaps That Need To Be Addressed

A Limitation In Traditional Financial Education

According to the TIAA Institute-GFLEC study, the focus of traditional literary programs is on theory rather than practical applications. Whether in schools, workplaces, or financial apps, you are given lectures, but there is a lack of real-world financial decision-making.

There are disparities among women, black & hispanic Americans, and younger adults, especially Gen Z. The systemic issues like limited access to professional advice and cultural differences in financial behavior are other highlighted issues. This concludes that education alone cannot bridge this knowledge gap.

Demographic And Generational Division

As mentioned above, financial literacy is distributed unevenly among demographic groups. According to the Financial Literacy and Retirement Fluency in America report, women, black & hispanic Americans, and Gen Z score below the national average.

Those adults with very low financial literacy are more likely to be constrained by debt and three times more at risk of being financially weak. For high-net-worth families, these differences emphasize the importance of personalized guidance and proactive planning to maintain generational wealth.

The Retirement Fluency

Retirement planning is one of the weak points for US adults. On average, only 23% of the individuals estimated the likelihood of needing long-term care, while 53% understood the ways to secure lifetime income. On average, adults answered only two out of six retirement-related questions correctly.

This lack of understanding results in underfunded retirement accounts, misallocated investments, and overlooked healthcare considerations. All these critical issues pose risks for wealthy families managing multiple retirement portfolios.

High Risk Of Comprehension

According to the 2025 TIAA Institute-GFLEC Personal Finance Index, only 36% of U.S. adults answered financial risk questions correctly. This was the lowest score among all measured areas. This reflects how poorly people understand risk concepts.

A weak understanding of these areas can lead to weak decision-making, leaving the individual unprepared for market fluctuations. For high-net-worth families, underestimating these risks can mean missing opportunities for growth.

This directly affects wealth preservation and long-term financial planning. Improving risk literacy isn’t just about knowing definitions. It is essential to build confidence, make decisions, and manage wealth effectively.

How Can High-Net-Worth Individuals Resolve This Issue

Resolving the financial issues requires a strategic approach. High-net-worth individuals and families must work with professional advisors. They also offer behavioral finance coaching. They provide tailored guidance with real-world applications. Learning to budget, manage risk, and design retirement plans will help them.

With personalized strategies, you gain practical financial knowledge that aligns well with your long-term goals. Collaborating with the advisors ensures that all the knowledge is being translated into action.

Final Words

These US financial literacy figures are not just a statistical concern. You need to take it seriously for wealth management. A consistency in not understanding the risks can lead to long-term financial insecurity. When you address these gaps through a thoughtful approach, you are turning your theoretical knowledge into practical knowledge. For high-net-worth families, addressing this issue is more critical. They need to work on sustainable wealth growth and manage the market fluctuations.