For a long time, women were labeled as cautious investors who waited before taking financial risks. This description is no longer true for 2025. Today’s women investors are more confident, clearer decision-makers, and excellent at taking risks. This is a trend clearly visible in current women investor statistics.

This shift has no connection with emotions. It reflects their critical thinking skills, the practical use of the data, and a focus on long-term outcomes. Women are successfully making decisions that align with real-life goals rather than short-term market noise.

For high-net-worth families, this shift is essential. This reshapes portfolio structures, legacy strategies, and wealth discussions across generations.

A Shift That Needs Attention

Remember, this shift was not the result of an overnight. It grew slowly as women became stronger. They had more access to education, advice, and digital tools. The market changes in recent years have also played a vital role.

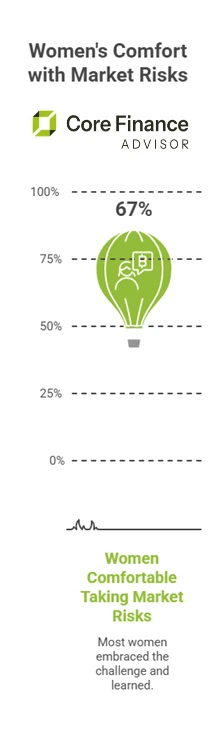

Instead of seeing this as a challenge, most of the women embraced it and learned through experience. According to the Charles Schwab Women Investors Survey 2025, 67% of women reported they were comfortable taking market risks. This signaled a measurable change in overall female risk tolerance.

From Being Cautious To Taking Confident Decisions

In the early decades, caution was often the response to exclusion. It was a time when women were not invited into serious investment conversations. In 2025, that barrier lowered. Now, it is believed that confidence comes from participation and not personality. Women have changed who they were in the past. They are changing how informed they feel.

-

Data Is Rewriting The Risk Narrative

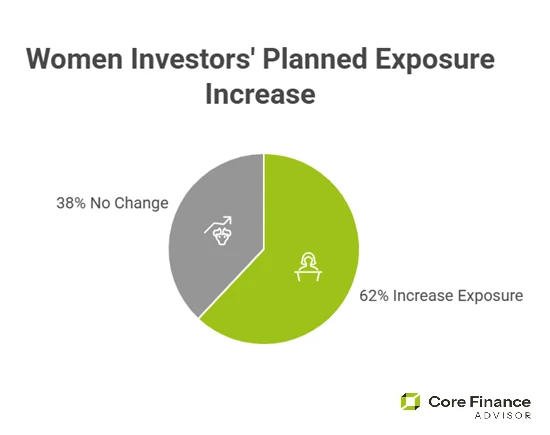

Recent studies show that women are no longer sitting on the sidelines. The iShares Women Investing Surveys show that 62% of women investors plan to increase their exposure over the coming years. This reflects trust in long-term growth rather than fear of short-term swings. Some of the points that shape this shift include:

- A rise in allocation to stocks and ETFs among women-led portfolios.

- A great use of diversifying strategies instead of cash-heavy positions.

- A higher participation rate in global-based investing models.

-

Discipline Drives Risk

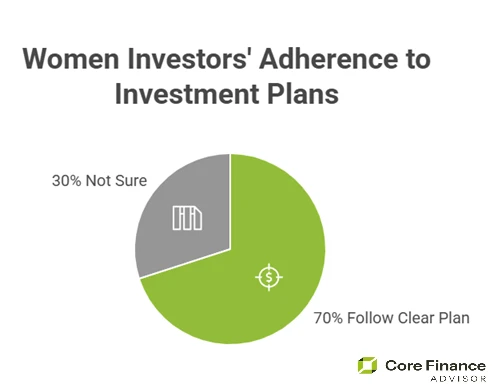

Higher risks are never due to careless behavior. The Schwab 2025 press release shows that women investors can balance patience with measured risk. An estimate of 70% say that they follow a clear plan and avoid emotional trading. These results help explain why higher risk tolerance does not lead to higher stress. Some of the habits that support this mindset include:

- Reviewing portfolios regularly instead of reactive moves.

- Supporting long-term benchmarks instead of reactive moves.

- Using professional advice as a sounding board and not a crutch.

-

Filling In The Investment Gaps

The gender investment gap has long been at the top, but 2025 shows real movement. Research cited by DIY Investor suggests that the gap is getting narrower as women increase their exposure. The growth of assets is a clear sign of closing the investing gap in real terms. This trend is found among younger high-income women and business owners. Some of the key factors in this shift include:

- An earlier engagement with the investing careers and education.

- Peer influence through a professional network.

- A great control over the household’s financial decisions.

How Does This Benefit Wealth Planning Families?

For wealthy families, this shift changes the way financial conversations happen, especially as the long-anticipated wealth transfer to women accelerates across generations. Now, risk tolerance is no longer assumed to be gender-based. Advisors and families need to listen carefully. Women are often focused on growth with purpose, not growth alone. Families make practical adjustments.

- They update investment policy statements reflecting shared risk views.

- Women are equally included in estate and succession planning.

- Designing portfolios that support both growth and flexibility.

Taking Risks With Purpose

In 2025, women investors are moving beyond just following market trends or making quick decisions. Many are building investment strategies that support longer lives, with career changes, and caring for family. They are more comfortable with risk. However, use it thoughtfully. As more families adopt this approach, they will be better prepared for the future. The real progress comes from making informed and steady choices in a constantly changing financial world.

FAQs

Why are more women investors taking risks in 2025?

They now have greater access to education and data, which helps them make better investment decisions.

Does taking on more risk reflect that women are making emotional trades?

Research shows that women tend to follow clear plans. They review their portfolios regularly and avoid making emotional decisions.

How is this change affecting investment portfolios?

Portfolios managed by women now tend to use more diversified strategies. These include more stocks and investing globally, rather than mainly holding cash.

Is the gap between men and women investors actually getting smaller?

As more women invest and take in a broader range of assets, data show the gap is closing.

What does this trend mean for wealthy families?

It is changing how families plan for the future. Risk tolerance is no longer just assumed. Women now have an equal say in decisions about family wealth and legacy.